Ever Heard of the Phrase, ‘Don’t Fight the FED?'

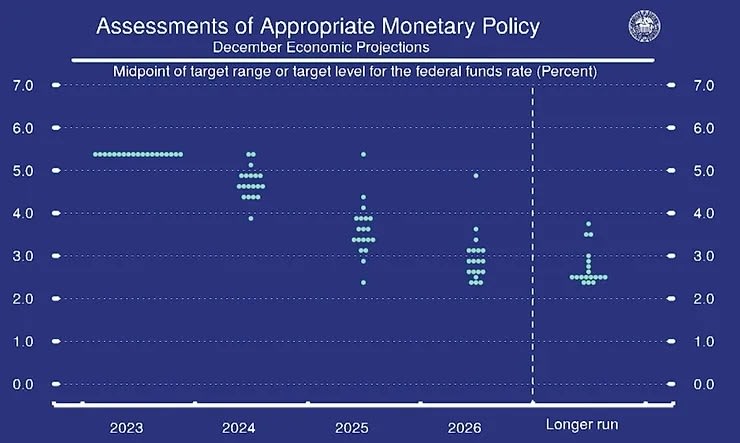

Today the Federal Reserve (Papa Powell himself) laid out a plan for cutting rates three time next year and three to four times in 2025 - with a target of around 2.0% to 2.5%. If you want to skip all of the interpretation and news filters placed on top, you can watch all 45 minutes of it - for you finance nerds out there. Just in case that sounds like too much sunshine and rainbows, he said multiple times that they were committed to their inflation target of 2.0% to 2.5%. So tightening could still happen in the future. It's easy to hear what you want to hear and skip all of those escape clauses, so this is not a forgone conclusion. The planned rate drop as seen in this chart is what I would call the 'happy path.'

This means we are in theory done with rate hikes, and the FED thinks we can slowly drop rates without stoking the flames of inflation as long as we go steadily forward. Now we all hope he is right, but who knows what geopolitical land mines are on the track ahead. Still, if the FED simply follows through and we manage to even stay close to 'the plan' it means a very important thing. We have reached the real estate bottom in pricing.

We Are at a Turning Point

Today mortgage rates dropped a full 0.5% to 6.5%. Some lenders are even in the 5-ish territory. It is rare to see so much movement in a single day.

Assuming rates slowly drop for the next two to three years, that means prices will likely bottom out and continue to increase during that time. Equities should also follow suit. Strangely enough, housing prices have actually gone up in most parts of the country year over year even with higher rates, although not a lot thankfully. Austin is an outlier in the opposite direction and has had a small drop, around 3%, but the proverbial cliff everyone has been screaming about just hasn't shown up. Wages are also growing at about 5% per year which helps close the affordability gap.

Not to sound like your stereotypical agent, but now is literally a great time to buy in at least the next twelve to twenty-fourth months. Because this just happened, market pricing will not be accustomed to these rates yet. Every house on the MLS just got a price drop with this announcement. Houses are still priced for yesterday's rates with the expectation of flat rate increases. We are also in December, traditionally one of the slowest months of the year because buying a house during the holidays just sounds like more than most people want to take on.

But Rates Are Going Down, Wait Until Next Year?

True money will get less expensive, but prices will respond accordingly and go up. So in a falling rate environment, you want to buy at a lower price and then refinance as rates go down. You could wait until next year and have a better rate, but will likely have a higher price.

As always, question everything and don't take suggestions as absolutes. These are written from a perspective of our experience and offer our insight, however limited. We're not perfect and get things wrong, but not on purpose.