This year we baked around 140 pies for our friends and clients this Thanksgiving. It's a wonderful time to have friends over and say thank you for being a part of our lives and choosing to do business with us. We hope you liked the pie. Were you sweet potato or pumpkin?

Darn Pies and Statistics

It's not hard to find headlines that predict doom and gloom or an optimistic rebound in the real estate market. It's either sell now or buy the dip! Sadly fear drives clicks so we are just more likely to read or watch news that predicts the worst. Usually, these predictions follow a specific format. They tend to focus on a single variable like interest rates, investor ownership, or growth rates to name a few and then predict what will happen based on the movement of that one metric.

It's a very compelling argument. Usually, the metric matches some part of the market or perfectly matches the inverse so it seems that it is directly correlated to what is happening although usually in the short term. So yes rates are going up and that is a big lever, but it's not the only one. Yes investors own more homes now than they have previously and so a shift in that ownership level could add a lot of surplus to the market. But all of these factors work in the unknown polynomial that we attempt to use to predict housing prices. The left side of the equation is never so simple.

Now I am not saying my formula is perfectly accurate. No one is. Rather I am simply wary of anyone using a single input to make a prediction. I like to apply long-term thinking to real estate investments and do my best not to get caught up in short-term emotional cycles. The simplest tactical decision you can make to buy is purchasing in the winter. That is consistently the low point in pricing year over year.

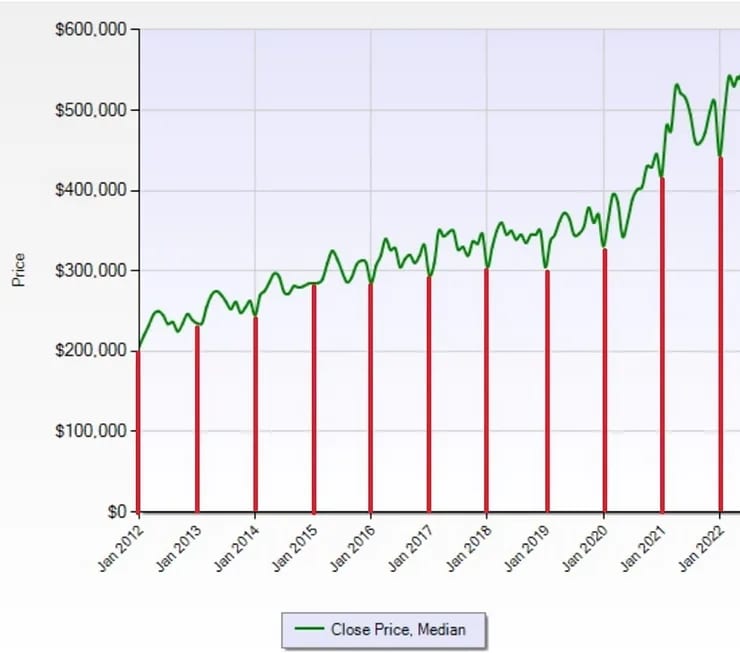

Each red line above is the January median sales price for a single family home in Austin, TX over the last 10 years. This is simply a result, the right side of the equation. I am not making a prediction other than the winter months historically have been the lowest price point of the year. The end of 2023 could have a new low that is lower than the end of 2022. That is a real possibility, however if I were to make a bet, I think the long-term trend will continue simply because Austin continues to grow and attract high end businesses and talent at a rate that is faster than we are building new homes. I would change my outlook if Austin became less desirable, or the city started to build faster than the absorption rate for a long period of time (over a year).

There are anomalies like the middle of 2015 and the spring of 2020, but probability suggests that if you want to optimize your purchase in terms of short-term timing, the winter is the time to do it.

The Other Misdirection

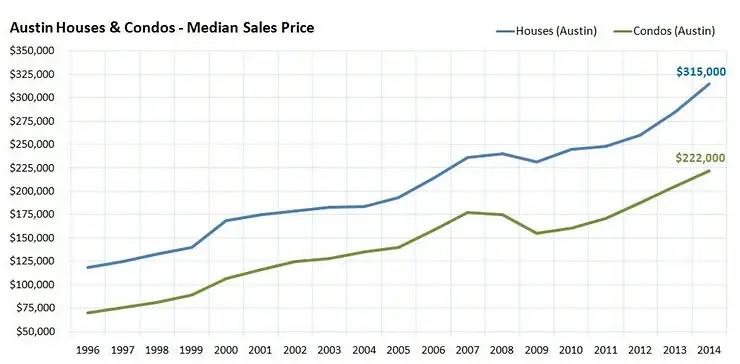

The above chart could be considered guilty of this, and that is looking at too short of a time frame. In any sin curve (which real estate markets inevitably follow as you can see many in the chart above, you can zoom in on any part and thus choose to show and up trend or a down trend. So time scale matters.

Austin Residence

This chart goes back to 1996, and you can see two years where prices went down. We could have those two years again, but my first chart just went back to 2012 so it looks like that down side can't show up. It is however difficult to find a 5 year period where housing prices in Austin don't go up.