It Was the Best of Times, It Was the Worst of Times. Austin Is Correcting but Bouncing Back

Austin home prices have fallen 10% since the peak in 2022, and are down 5.3% in the Austin-Round Rock-Georgetown metro in the last year 2023 - 2024. Now you can find different numbers depending on if you just stick to Austin or change the month you look at the year to year trend, but overall the Austin market is correcting itself after the epic run up in prices of over 40% to the peak in 2022. So it is no surprise that we are on the back side of that roller coaster.

The interesting thing is that the US market overall is still increasing in price. The median price of a home in the US today stands at $420,000.

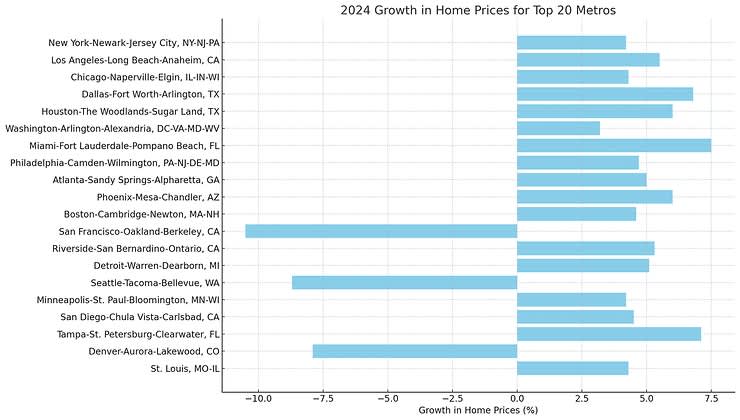

The chart below shows the top 20 metro areas in the Unites States by population and their median home price growth in the last year. This nets out to an increase of course with some exceptions. Linear data models can be misleading. The list below represents 35% of the total value of the US housing market. Tech hubs like San Francisco, Seattle, and Denver all have taken hits, while the rest of the country marches on even with interest rates where they are now.

The Rest of the Nation Is Seeing Higher Prices

Now real estate is local of course so average numbers across the US are almost purely emotional and academic. The number that matters most is the one where you live. The meta insight however is that prices continue to rise even with high interest rates. Everyone is expecting a drop later this year, but it is going to be a small one, maybe a quarter-point drop in September and another in December at most which are likely already priced in. So why are prices still going up, and technically even in Austin more recently? It simply comes down to supply. We still don't have enough homes, and high interest rates have a double compounding effect of reducing the amount of buildings that are started.

Even in my small building business where I may build one ore two homes a year, I am not building anything right now because it just doesn't make sense. Land prices are high, labor costs are high, materials are high, and sales prices just don't support a price that makes it worth starting. So the only builders that can make product right now are the ones that benefit from economies of scale that are building on the outskirts where land is cheap and they can buy both debt and lumber by the train cart.

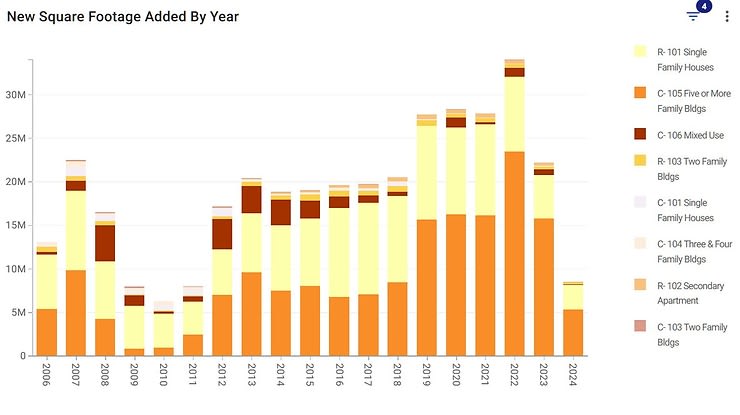

The same is true for multifamily starts. The chart below shows new residential starts which have been falling from their peak in 2022. Now to be fair, 2024 is not done yet, but at the half way point it doesn't look like it will be as high as 2023.

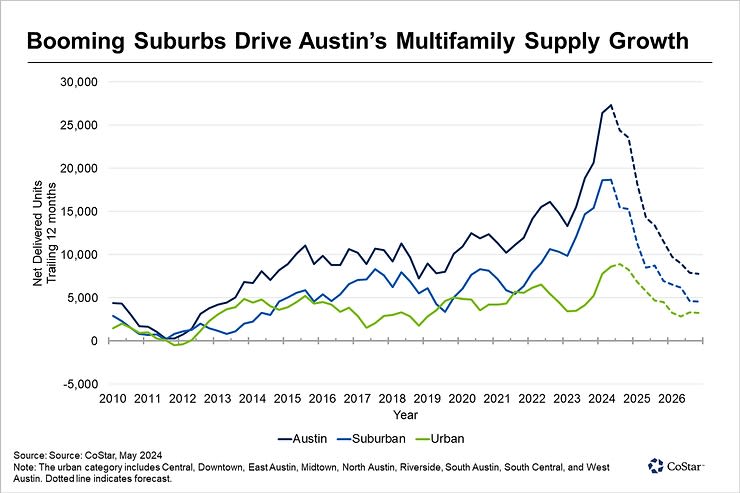

The counterintuitive part is that rents are going to go down in the coming years because the chart above represents starts. It turns out that it takes a while to complete a multifamily building, the chart below shows supply added to the market. Look at that spike! It's going to take some time to absorb that inventory which means rents will have to come down, there is no way around it.

However, large spikes in most charts mean the other side of that coin will come to bear at some point. Most apartment builders will just wait until conditions improve both in rents and rates to start any new buildings, and when they do supply will likely be very tight because years from now the gap in lack of building is going to create the opposite problem of no supply and much higher rents, but it will take 2-4 years to materialize. 2027 is going to be a great year to sell multifamily assets. Go ahead, put it on your calendar and ring me up (512) 910-5315 and see if I was right. It is sure to happen barring some unexpected drop in population.

When Will It Turn?

Three things make up housing prices, ok more than three, but these are the ones I think are the biggest levers, wages, interest rates (together these make up demand), and supply.

Unemployment is still relatively low, but the Sahm rule suggests that may change soon. Wages are so far still growing around 5% (slightly inflationary). Interest rates are going to come down at least a little, and potentially a lot more because the Fed may be forced to buy US debt because it's getting harder to sell it to equally indebted foreign countries and it is expanding at the rate of 1 Trillion every three months (very inflationary). Supply is constrained because builder's are finding it harder to generate profits with today's economics (inflationary).

There are a few bright spots. The commercial real estate market is in trouble which could be several newsletters in itself, as this resolves it could cause financial institutions to tumble and tighten which is deflationary. AI enhancements in productivity would also be deflationary but we haven't seen that show up in the GDP numbers yet. They hype has yet to land, but I do get a lot of work done faster with ChatGPT. It did not write this article for me.

To me it looks like the inflationary parts of the balance sheet outweigh the deflationary ones at least for now. I don't see home prices coming down in the long run unless we have a loss of liquidity like 2008 which is politically unlikely or we manage to drastically increase supply which doesn't look probable either.

I predict that after the US election rates will drop. In the case of a Trump victory he will put pressure on the Fed to drop rates; this is just a guess of course. Regardless of who wins, the government is still having trouble selling its debt, so much that the treasury is closing out long term debt at lower interest rates in favor of 1 year T-Bills at higher rates to provide more liquidity.

Once the Fed has to start increasing its balance sheet again to be the buyer of last resort we will see more inflation in real estate prices. Dropping interest rates will also have an added benefit of saving or at least easing the commercial real estate market. It's a question of which pain the Fed wants avoid more.

Buy or Sell?

It is tough to sell right now. Several of the previously hot zip codes like 78702 and 78704 are getting less than 10 contracts per week while having 300 to 400 listings. It varies greatly by zip code but some of the previous epicenters have gone cold for now. There are still buyers but fewer of them so they have more choice than ever in today's market.

Prices have come down for sure but not enough to make homes affordable for most buyers. Austin's home price to income ratio currently sits at 6.0. Los Angeles is the worst large metro in the country at 12.5. Glendale, CA is 15.2 and Newport Beach, CA is 25.4! An affordable market should be around 3.0 or less.

Cash buyers have the most power right now because they are not subject to interest rate risk and can choose to finance any time it makes sense. There are some good offerings in new construction on the outskirts of town where land is still inexpensive and builders buy loans in bulk and can offer lower rates to buyers in those communities. That is the real bright spot right now.

However, sometimes you just need to move. Every market has its price where homes will move, it just may take a while.

Like the fast markets, this market too shall pass. Austin remains a vibrant city that attracts a lot of people and the long-term growth is highly probable.

As always, question everything and don't take suggestions as absolutes. These are written from a perspective of our experience and offer our insight, however limited. We're not perfect and get things wrong, but not on purpose.